Senior Whole Life Insurance for Dummies

Wiki Article

About Whole Life Insurance

Table of ContentsNot known Details About Senior Whole Life Insurance Senior Whole Life Insurance - Truths9 Simple Techniques For Life Insurance Louisville KyHow Whole Life Insurance Louisville can Save You Time, Stress, and Money.Getting The Kentucky Farm Bureau To Work

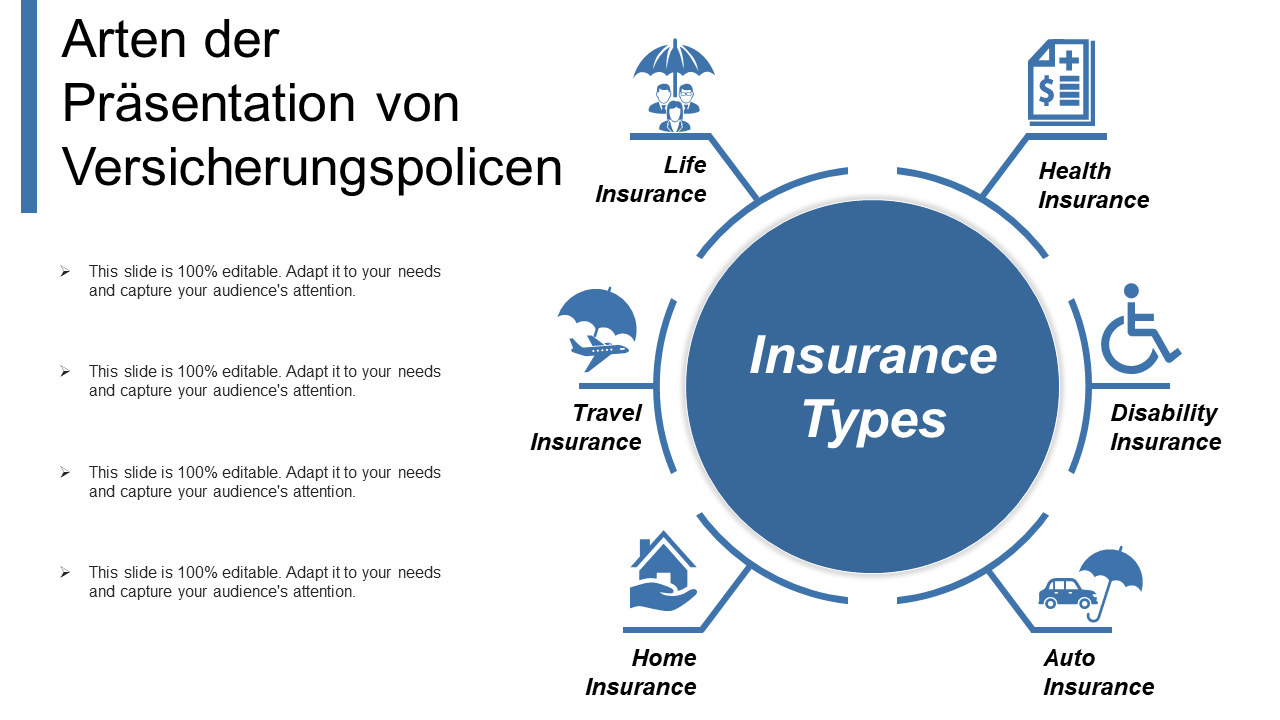

19. 1 Definitions and Kinds Of Insurance Discovering Purposes Know the basic kinds of insurance coverage for individuals. Name and describe the different kinds of business insurance coverage. Certain terms are usefully defined at the start. Insurance policyAn agreement of reimbursement. is a contract of reimbursement. It compensates for losses from defined hazards, such as fire, cyclone, as well as quake.The individual or company guaranteed by an agreement of insurance policy. (often called the guaranteed) is the one that obtains the payment, except in the case of life insurance policy, where settlement goes to the beneficiary called in the life insurance coverage contract.

Some Ideas on Life Insurance Companies Near Me You Need To Know

Every state currently has an insurance coverage division that looks after insurance rates, plan criteria, gets, as well as other aspects of the sector. Over the years, these divisions have actually come under attack in several states for being inadequate and "slaves" of the industry. Big insurance providers run in all states, as well as both they and customers must contend with fifty different state regulatory schemes that give really various levels of security (Kentucky Farm Bureau).Public and also Private Insurance coverage Occasionally a distinction is made between public and also personal insurance. Public (or social) insurance includes Social Protection, Medicare, momentary special needs insurance coverage, as well as the like, funded through government strategies.

The emphasis of this phase is private insurance policy. Types of Insurance for the Person Life Insurance policy Life insurance coverage gives for your household or some various other called recipients on your fatality. Life insurance policy with a death advantage however no built up savings.

Term Life Insurance Louisville - Questions

Health Insurance Wellness insurance covers the cost of a hospital stay, brows through to the doctor's office, as well as prescription medicines. Life insurance. The most valuable policies, offered by several companies, are those that cover 100 percent of the prices of being hospitalized and 80 percent of the fees for medication and also a doctor's solutions. Typically, the plan will certainly include an insurance deductible amount; the insurance firm will certainly not pay up until after the insurance deductible quantity has actually been reached.

Special needs Insurance A handicap plan pays a specific portion of a staff member's wages (or a fixed sum) regular or monthly if the employee becomes not able to overcome ailment or a mishap. Premiums are lower for plans with longer waiting periods before payments must be made: a policy that starts to pay a handicapped employee within thirty days may set you back two times as long as one that delays payment for 6 months.

Life Insurance Online Can Be Fun For Anyone

Car Insurance Car insurance coverage is perhaps one of the most frequently held kind of insurance - Term life insurance. Auto plans are required in at least minimal quantities in all states. The common automobile plan covers obligation for physical injury and residential property damage, clinical payments, damage to or loss of the auto itself, as well as lawyers' charges in situation of a claim.A personal obligation plan covers several kinds of these threats and also can give protection in excess of that given by homeowner's and also automobile insurance coverage. Such umbrella insurance coverage Web Site is generally rather inexpensive, possibly $250 a year for $1 million in responsibility. Sorts Of Organization Insurance Employees' Settlement Almost every service in every state need to guarantee against injury to employees at work.

Rumored Buzz on Cancer Life Insurance

Negligence Insurance Coverage Professionals such as medical professionals, legal representatives, and also accountants will certainly commonly purchase malpractice insurance coverage to secure against cases made by dissatisfied individuals or clients. For medical professionals, the cost of such insurance coverage has been rising over the previous thirty years, mostly as a result of larger court awards versus medical professionals who are negligent in the method of their occupation.Obligation Insurance policy Businesses encounter a host of threats that could cause significant responsibilities. Several sorts of plans are offered, including plans for owners, property owners, as well as renters (covering liability sustained on the facilities); for makers and contractors (for responsibility incurred on all facilities); for a firm's products and also finished procedures (for responsibility that results from guarantees on products or injuries caused by items); for owners as well as service providers (safety obligation for problems triggered by independent contractors involved by the guaranteed); and also for legal obligation (for failure to follow by performances called for by certain contracts) (Life insurance companies near me).

Today, most insurance coverage is readily available on a plan basis, via single plans that cover one of the most important dangers. These are usually called multiperil plans. Key Takeaway Although insurance is a requirement for each United States business, and also numerous companies operate in all fifty states, regulation of insurance has stayed at the state level.

Report this wiki page